For years the only way to manage your business financials was with pen and paper. Fast forward to 2021, and there are so many ways to help you keep track and manage business expenses that it’s confusing. Platforms like Excel, Quickbooks, and Freshbooks are used based on preferences and skillsets.

Unfortunately, some of the software programs and Microsoft Excel can be difficult to use. In this case, it may be easier to use pen and paper. The downside is that using pen and paper can be time-consuming and may lead to unnecessary errors. Thus, it is best to learn how to properly use and incorporate a suitable software program to manage your financials.

Notably, Excel is often free as it is apart of many computer software packages. However, it has a bit of a learning curve. For instance, you would need to apply the proper formula in the appropriate cell to add or subtract. Once you know and understand how to use the correct formula, you will never have to worry about arithmetic errors again.

I use both Quickbooks and Microsoft Excel. Below I will explain to you in detail how I use them both. It may be in your best interest to explore all options before finding the one that fits your business needs.

How I Manage my Small Business Using Excel Spreadsheets

I started using Quickbooks early in our business because it was free for start-ups. In the beginning, my knowledge of Quickbooks was limited to adding new clients and creating invoices. However, as our business grew and we became a paying customer, I soon increased my financial literacy. I learned how to integrate my bank with Quickbooks, match expenses, do payroll, and more. It is safe to say; without Quickbooks, I lose my financial bearings.

Although Quickbooks is my champion, it became apparent that I needed more structure. Besides keeping track of our income and expenses as they accrued, I desperately needed a workable budget to stay on track. At this time, I turned to Microsoft Excel and searched for a budget template I could use.

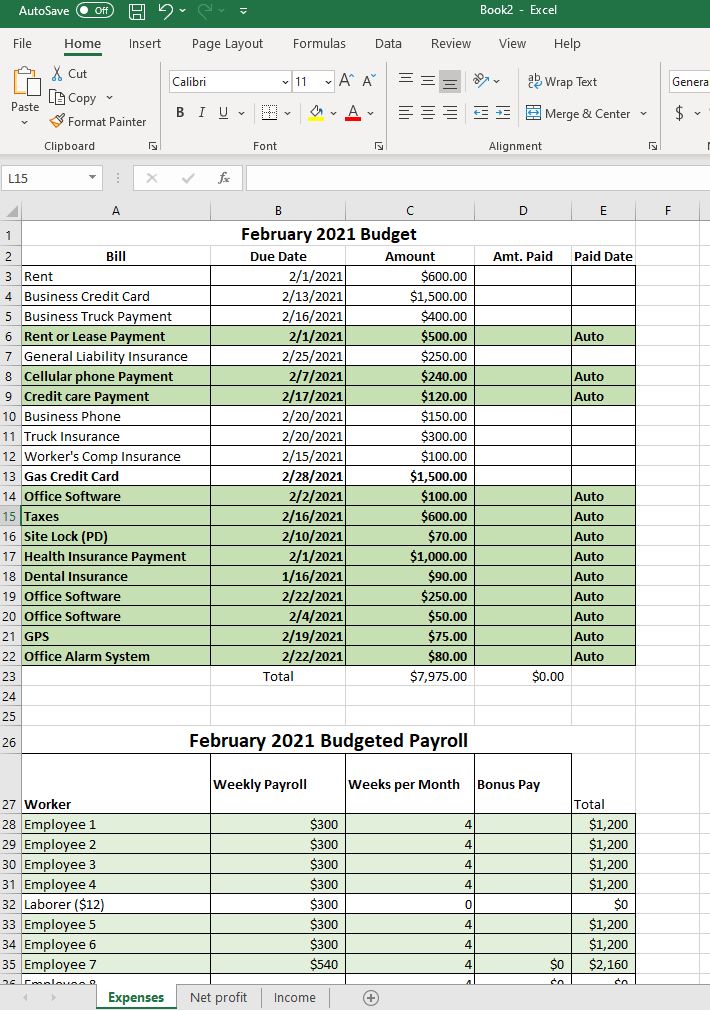

Indeed, I tried a few Excel budget templates that just did not fit my business. So, I decided to create my own. With the help of YouTube, I customized a monthly budget for my business that outlined my ongoing expenses, payroll, variable expenses, to include a sheet for income and profitability. Finally, I had foresight on the business financial stability for the month.

Here is an example of the layout of our fixed expenses on Excel.

“Beware of little expenses. A small leak will sink a great ship.”

Benjamin Franklin

Simple Ways to Manage Your Business Financials

Dave Ramsey says you should have 6 to 12 months of expenses set aside for your business. If you are starting your business, this is valuable advice. To take it a step further, I would fund my reserve account based on my organizational chart’s focused needs. The ultimate goal is “to work on your business, not in your business.”

- Set up a business account (checking and savings)

- Set up your business on a financial software program.

- Use Excel Templates or create a customized monthly budget.

So, one of the first steps is to set up a business checking and savings account. If possible, a federal credit union would be best; we’ll talk about that more later. It is critical to your financial success to have your reserve account fully funded. Proper funding will give you the confidence needed to focus on being the visionary of your business and make decisions with ease.

Invest in a good financial software program, such as Quickbooks. With the Quickbooks premium program, they offer online self-paced training to help you get started, and accounting pros are ready to help should you need them.

Let’s not forget, you can use Excel to create an excellent workable monthly budget. Having this information will keep you from struggling to make ends meet monthly. This knowledge will ensure you and your employees will be paid based on your set income.

Lastly, use some of the FREE RESOURCES I discussed in my previous post. I learned a ton about QuickBooks and managing our business financials from my SBDC mentor.

I hope this information helped you to get started with the financial structure of your business. If you have more questions, please join the Deliberate Start Hustle. You can post your questions there and get help from other entrepreneurs that understand your situation.